The post Is It Better to Lease or Buy a Car? appeared first on Good Financial Cents®.

]]>If you want to own a car outright — and to enjoy some time without a dreaded car payment — buying a car is the obvious choice. If you don’t care about car ownership, leasing a car is more prevalent than some drivers realize.

According to Experian’s Q4 2022 State of the Auto Finance Market study, 26.45% of all new vehicles were leased last year, with Hondas and Toyotas being the most popular car makers.

While leasing is still a popular option, the percentage has dropped significantly – over 17% since its high during the pandemic. Leasing a car can also mean a more affordable monthly payment, depending on your scenario.

Before deciding whether to purchase or lease a car, think about your finances and your lifestyle. This guide can help you decide what to consider before buying or leasing a car, along with the pros and cons of either option.

Table of Contents

How Does Buying a Car Work?

You can purchase a car outright if you have the cash, yet most consumers use auto loan financing to facilitate their purchase.

In fact, the same Experian report found that 81.12% of new vehicles were purchased with a car loan last year, and 34.59% of used vehicles were purchased through financing.

Car Financing Today

The prevalence of financing has to do with the high cost of cars and trucks, and especially new vehicles.

Experian revealed that consumers purchasing a new car financed an average of $41,445 in 2022, compared to $35,228 in 2021. That brings the average new car payment to $716 in Q4 of last year — a new record high.

The fact consumers are borrowing higher amounts also leads to new car loans with significantly longer terms.

In fact, 42.13% of new car loans were for 61 to 72 months in Q4 of 2022, and 30.21% opted for loans that lasted 73 to 84 months. A very small percentage (1.41%) even opted for auto loan terms longer than that.

Whatever payment route you decide on, there are several ways to purchase a car. You can buy your new ride from an auto dealership, but can also opt for a private sale or an auction purchase.

If you don’t have the cash to pay for your car outright, you can see if you qualify for in-house dealer financing or look for a third-party auto loan.

You can use marketplaces to compare auto loan rates for new and used cars. For example, a few marketplaces we recommend are Auto Approve, AUTOPAY, myAutoloan, or RateGenius. These sites can help you find the lowest auto loan rate you qualify for.

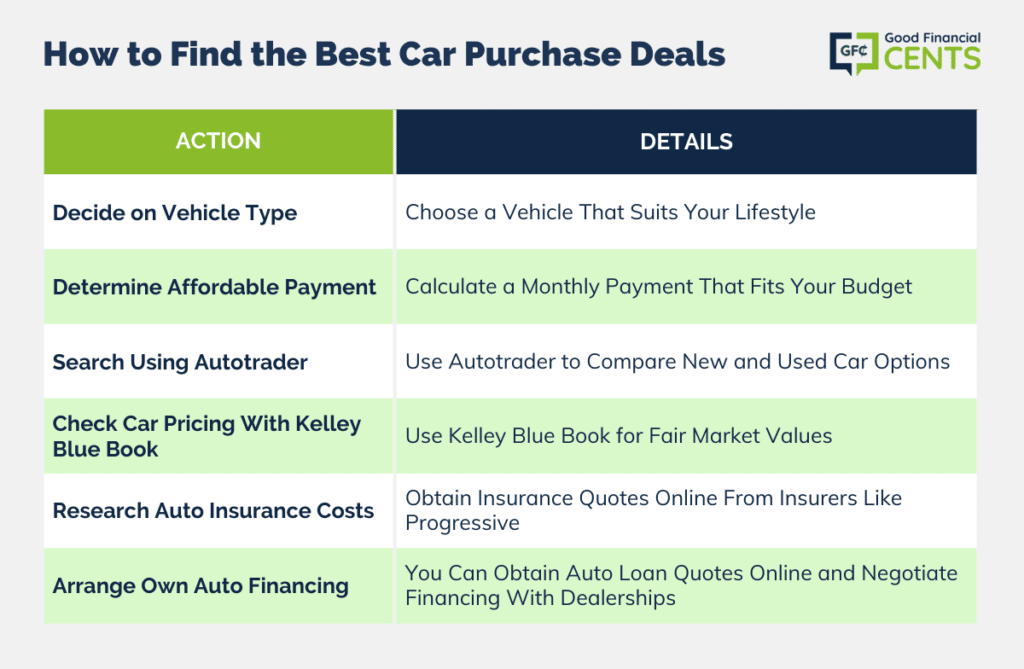

How to Find the Best Car Purchase Deals

Thanks to technology, finding the best car purchase deal is easier than ever. Consider these tips as you look for a new or used car to buy:

Decide on the Type of Vehicle That Fits Your Lifestyle

Consider the type of vehicle you want the most. If you have a family in tow, you might consider a minivan or an SUV for the extra space.

If you want fuel economy, consider a smaller, fuel-efficient car or even an electric model. According to Experian, more than 55% of new vehicles purchased in the last quarter of 2022 were SUVs.

Determine How Much You Can Afford

Make sure the cars you’re considering come with a monthly payment that fits in your budget. An auto loan calculator can help you determine the monthly payment for cars in your price range.

Look for New and Used Cars in Your Area Using Autotrader

Once you decide on the type of vehicle you plan to purchase, search for options using Autotrader. This website lets you compare pricing, and features and upgrades among new and used cars.

Gauge New or Used Car Pricing Using Kelley Blue Book

Once you’re serious about a specific car make and model, it’s helpful to know its fair market value. Kelley Blue Book lets you enter a car model and its features and tells you the average value you should expect to pay with a dealership or through a private sale.

Research Auto Insurance Requirements

See how much car insurance costs for the vehicle. You can visit any online national insurer, like Progressive, to get a quote.

Line Up Your Own Auto Financing (If Required)

Finally, keep in mind that you don’t have to use dealership financing to buy a car. You can get a quote for an auto loan online and then head to the dealership to negotiate for the best possible deal.

How Does Leasing a Car Work?

When leasing a car, you’re borrowing it for a specific term. You won’t build any equity in the vehicle at all, but you’re generally off the hook for repairs during your lease term since the car is most likely under warranty.

Although leasing comes with downsides, it’s still a popular option for people who want to drive a new car most of the time. Leasing lets you get into a new car, drive it for a few years, and then upgrade to a new lease and start the process all over again.

You’ll never have to worry about selling a car so you can move on to a newer one, nor worry about having negative equity in your trade-in.

According to Experian, the average lease term worked out to a little over 36 months (36.46 months) in Q4 of 2022. Meanwhile, the average monthly payment for leases was $460 per month.

How to Find the Best Car Lease Deals

If you’ve decided to lease a vehicle instead of buying one, you’ll want to start your search at major car dealerships that offer new vehicles. Here are some tips that can help you find the best lease deal.

- Decide on the Type of Vehicle You Want to Lease: Compare car options you might be interested in leasing. Do you want to lease a luxury car you can’t necessarily afford to purchase outright? Do you need a reliable car to get to work?

- Search for Lease Deals Online: Once you know the type of car you want to lease, check the websites of local dealerships in your area. Most will have lease deals prominently displayed on their websites so you can search and compare with ease.

- Look for the Lowest Possible Monthly Payment: Since leasing means you never own the vehicle, your main goal should be finding the lowest monthly payment you can. Also, make sure the lease timeline is ideal for your needs, whether you want to lease for a year, 24 months, or longer.

- Consider the Down Payment: Check down payment requirements for leases, keeping in mind that luxury leases often require a down payment of several thousand dollars upfront. This down payment might lower the monthly payment on your lease, but you won’t really “get†anything for it in return.

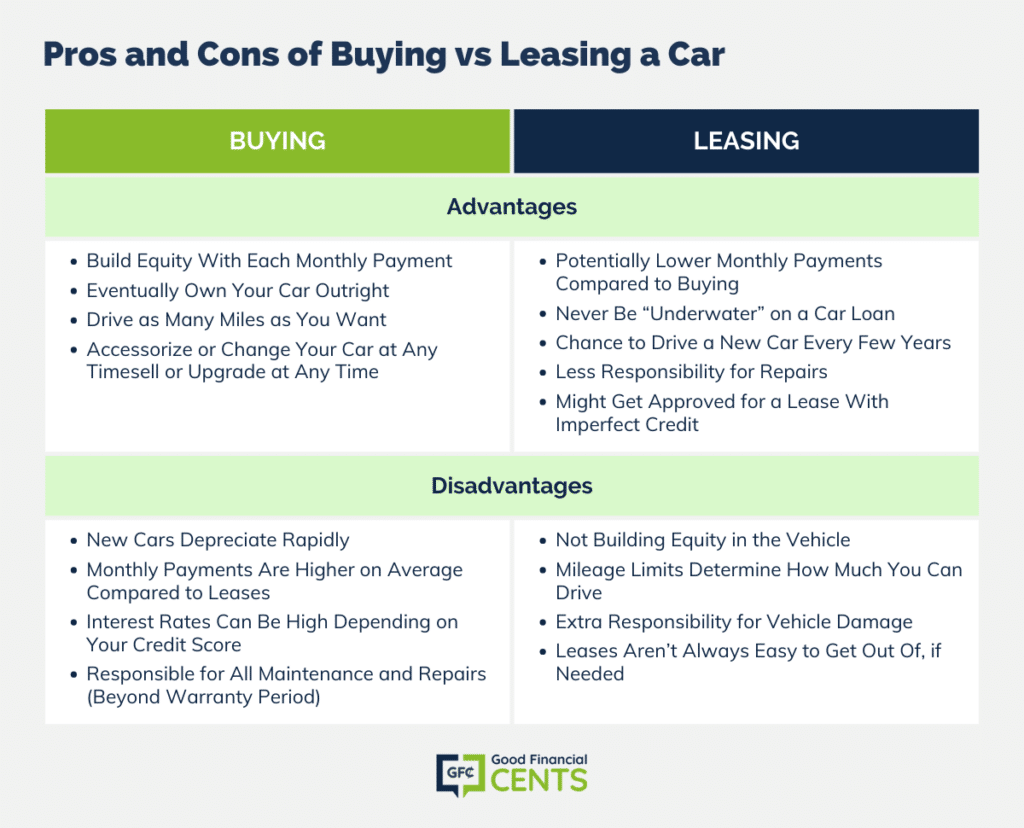

Pros and Cons of Buying a Car

Buying a car can be a better option if you plan on keeping a car for multiple years. That’s because driving for several years lets you build equity in a vehicle, which you can use for trade-in value down the line.

If you keep your car long enough, you could even own it outright and enjoy not having a car payment for as long as you can. Meanwhile, owning a car also means you can drive your car as many miles as you want and deck it out with the latest accessories.

Just remember that owning a car means you’re responsible for maintenance and repairs, at least, once your warranty period expires.

Who Should Buy a Car?

- Consumers with excellent credit who can get the best auto loan rates

- People who plan to drive a vehicle for at least three to four years

- Drivers who want total control of their vehicle, including mileage

- People who want to build equity with each monthly payment they make

Pros and Cons of Leasing a Car

Leasing a car can be a better choice if you love regularly driving a new car. It might be an option for those who want to avoid having negative equity in a car or going through the hassle of selling an older vehicle.

Since leasing typically requires a lower monthly payment, you might be able to afford a lease for a car with more equipment or upgrades than you could with a new car purchase. Just remember that leasing means you never really own the car, and you’ll always have a car payment.

Leasing also comes with mileage limits that can be cumbersome depending on how much you drive, and you won’t be able to accessorize your car in any permanent way.

Who Should Lease a Car?

- People who enjoy driving a new car every few years

- Drivers who want the lowest monthly payment for the best car they can afford

- People who don’t care about building equity in a car

- Anyone who wants a car that’s always covered under warranty

Questions to Ask When Deciding Between Buying vs. Leasing a Car

If your primary objective is saving money over the long-term, then buy a car and drive it into the ground! Conversely, you can also drive a new or used car until the repair costs signal that it’s time to upgrade.

If you prefer driving a new car all of the time, leasing is easily the better choice. This is especially true if you’re not bothered by having a car payment indefinitely.

Before buying or leasing a car, ask yourself the following questions:

- How long do I want to keep my next vehicle?

- Do I want a lower monthly payment or the chance to build equity?

- What’s my budget?

- How much do I drive, and can I live with mileage limits on a lease?

- How is my credit score? What’s the best auto loan rate I can get?

- How will buying or leasing affect my auto insurance rates?

The Bottom Line – Buy or Lease a Car

When it comes to making a decision about whether to buy or lease a car, there is no one-size-fits-all answer. Both options come with advantages and disadvantages that need to be weighed before choosing the best one for your individual situation.

Ultimately, you’ll want to consider factors such as budget size, how much use you plan on getting out of the car, your driving habits, and credit score.

By taking the time to evaluate all aspects of the decision-making process carefully, you’ll be better prepared to make an informed choice that fits your own unique needs.

The post Is It Better to Lease or Buy a Car? appeared first on Good Financial Cents®.

]]>The post Best Car Insurance for Young Drivers in 2024 appeared first on Good Financial Cents®.

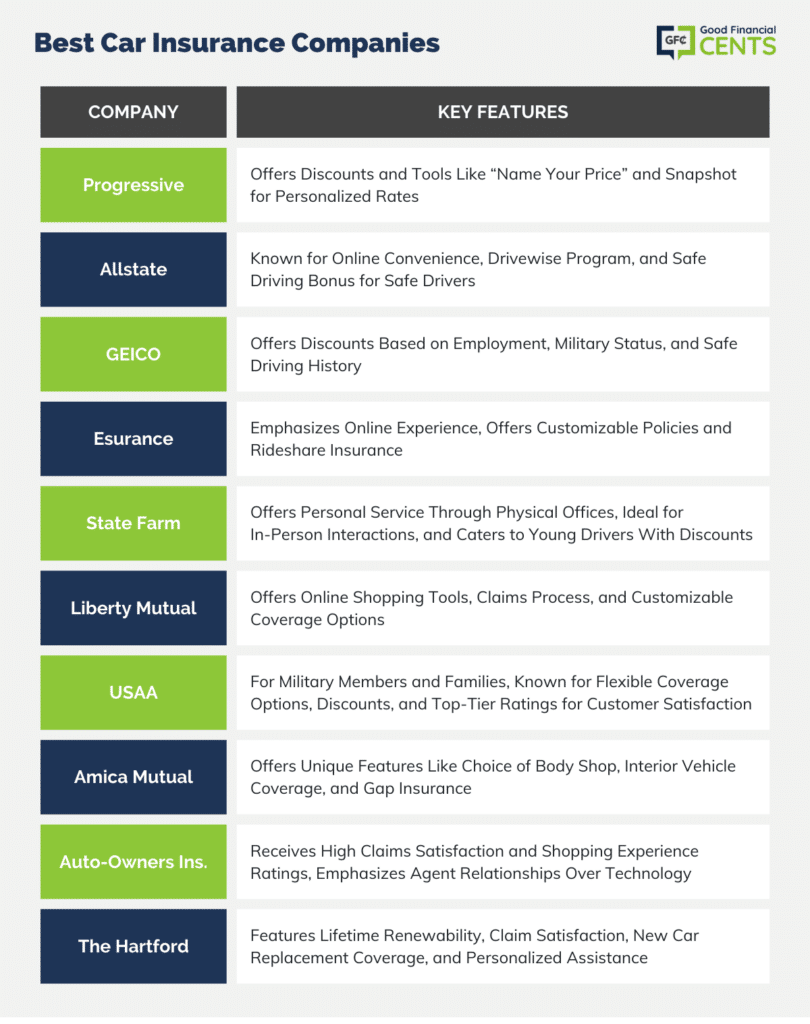

]]>That said, the best car insurance for young drivers offers quality protection for the entire household without breaking the bank. If you’re looking for the best cheap car insurance for young adults, however, you’ll need to compare policies and plans while also checking for discounts you might qualify for.

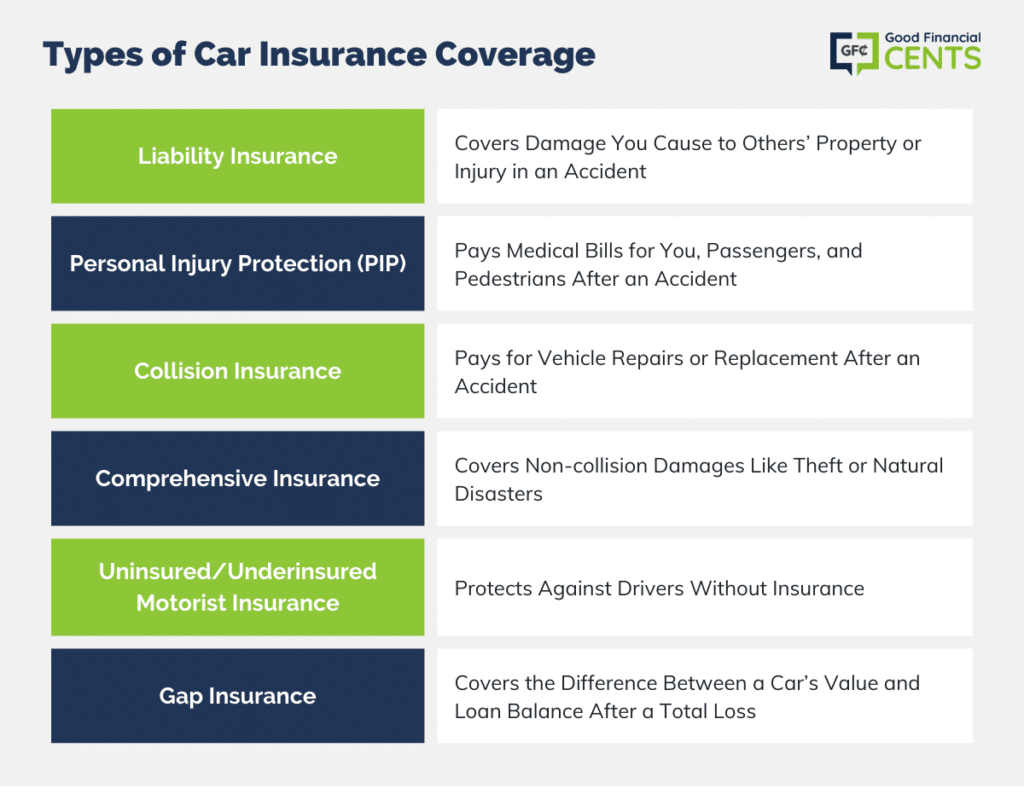

In the meantime, you’ll want to see which types of auto insurance you really need and which ones you can go without.

Table of Contents

We compared more than 20 of the best auto insurance companies to help you find the best car insurance for young drivers in 2024. If you’re ready to buy a policy or begin comparing all your options, you can stop looking and start your search here.

Our Picks for Best Car Insurance for Younger Drivers

- Nationwide: Best for Teen Drivers

- American Family: Best for Usage-Based Discounts

- Allstate: Best for Good Students

- State Farm: Best for Safe Vehicle Discounts

- Geico: Best Discounts Overall

- USAA: Best for Military

The reviews below can help you learn more about the best car insurance companies that made our ranking, including the policy options and special programs for young drivers they offer.

Nationwide offers an array of coverage options for teenagers and young drivers, as well as discounts that can make coverage considerably more affordable. Young drivers can purchase insurance with liability-only coverage, but they can also opt for collision coverage, comprehensive coverage, and even rental car reimbursement coverage that kicks in when a car is in the shop getting repairs after an accident occurs.

Accident forgiveness is another optional feature for young drivers. This add-on coverage ensures that a teen or young driver’s car insurance premiums won’t surge right away after their first at-fault automobile accident occurs.

Major discounts available from Nationwide for teens and young drivers include:

- Good Student Discount: If you’re a full-time student and a Nationwide customer, you can get a discount on your premiums if you maintain a grade point average of ‘B’ or better.

- Employer-Sponsored Plan Discount: If you work for an employer who participates in a Nationwide discount plan, you can get a break there.

- Multi-Policy Discount: You can also get a discount by bundling your auto insurance with other policies, such as renter’s insurance.

- SmartRide Discount: Nationwide also offers a discount if you meet safe driver criteria as determined by the use of a plug-in device. It’s a usage-based insurance program that enables you to earn a discount for safe driving.

American Family Insurance is another highly-rated insurance company that extends coverage to young drivers and teenagers who are being added to a family plan. This company offers all the basic insurance coverage you would expect, from liability coverage to collision, comprehensive coverage, uninsured and underinsured motorist coverage, and rental car reimbursement. They also offer optional emergency roadside coverage, which can be accessed with ease using the MyAmFam mobile app.

This company also offers a Safe Driver Discount Program for Teens, which monitors your teen’s driving habits with the help of a mobile app. Once a teenager drives at least 3,000 miles with the app on, families can qualify for a 10% discount on their car insurance premiums.

Other notable discounts for young drivers include:

- Away at School Discount: This discount can apply when a young driver is away at college or university and their vehicle remains parked at home.

- Good Student Discount: Students with good grades can pay less for auto insurance premiums overall.

- Multi-Product Discount: Pay less for car insurance premiums when you bundle multiple policies with American Family.

- Young Volunteer Discount: This discount can apply when a driver under the age of 25 completes 40 hours of volunteer work per year for a non-profit.

Allstate is another insurer that is known for its Accident Forgiveness program. While joining this program doesn’t help you lower your premium at first, you won’t see your monthly auto insurance costs surge after your first accident. In the meantime, Allstate also has a Safe Driving Bonus program. If you add this feature to your policy, you get a check in the mail every six months if you don’t have an accident. This is Allstate’s way of incentivizing safe driving habits.

Also, note that Allstate extends good student discounts for drivers who are under the age of 25. This means high school students and teenagers with good grades can help their parents secure lower car insurance rates, but it also means young adults in college can get a discount on their own policies.

Allstate’s best car insurance discounts for young drivers include the following:

- Allstate Drivewise Discount: Young drivers who install a device on their vehicle and let Allstate monitor their driving habits can pay less for auto insurance overall.

- Multi-Policy Discount: A multi-policy discount can apply when young drivers purchase multiple policies from Allstate, such as car insurance bundled with a renter’s insurance policy.

- Responsible Payer Discount: If you pay your premiums on time for an entire year, you can get a responsible payer discount the next year you purchase coverage.

- Smart Student Discount: This discount applies to drivers under the age of 25 who meet one of three options, including getting good grades or completing a teen driver education program.

State Farm offers a program for young drivers under the age of 25, which is called Steer Clear. This program requires drivers to use a mobile app that monitors their driving, and it is only available to young drivers who don’t have any at-fault accidents or moving violations within the last three years. Those who qualify for this program can save up to 20% off their auto insurance premiums when they avoid accidents and drive safely over the long run.

Not only does State Farm make it easy to add a young driver to a household car insurance policy, but they also offer affordable premiums for young drivers who are out on their own. Additionally, this company offers an array of discounts that relate to vehicle safety instead of the age of the driver, including passive restraint discounts and discounts for having an eligible anti-theft device installed on a vehicle.

Other discounts for young drivers offered by State Farm include:

- Drive Safe & Save Discount: This program uses information from your smartphone or your vehicle’s OnStar or SYNC communication service to calculate your discount.

- Defensive Driving Course Discount: Young drivers who complete a defensive driving course can receive 10% to 15% off their annual car insurance premiums.

- Student Away at School Discount: If you are a student under the age of 25 and you are living away from home while enrolled in school, you might qualify for this discount.

- Good Student Discount: This discount can cut your auto insurance premiums by as much as 25%, but you do have to post good grades to qualify.

Geico is one of the most price-competitive auto insurers on the market, and it offers quite a few discounts and programs for young drivers. For starters, this provider offers a family pricing program that lets young drivers get the same policy rates as experienced drivers within the same family. This means young drivers get the chance to establish a good driving record without paying high premiums that are typical for new drivers.

Geico also offers an Accident Forgiveness Program for drivers of all ages. This discount applies to only one member of the family on a single policy, but it helps prevent surging premiums in the event of an at-fault accident.

Other popular discounts from GEICO include the following:

- Good Driver Program: Young drivers can save up to 22% off car insurance premiums with the Five-Year Accident-Free Good Driver Discount.

- Government Employee Discount: This discount is valid with participating employers, yet it’s also available to federal employees. It can reduce your premium by up to 12%.

- Military Discount: Save up to 15% off your premiums if you’re a member of the military.

- Good Student Discount: This discount is available to drivers between the ages of 16 and 24 who are full-time students with a “B†average or better.

If you’re a member of the military or an eligible family member, you may also qualify for auto insurance through USAA. This company is one of the highest-rated insurance companies across the board, and they offer an array of programs and discounts for young drivers and teenage drivers alike.

As an example, USAA offers a program called SafePilot that can help anyone save up to 30% off their car insurance premiums if they complete a safe driving program and live in an eligible state. Families who have a teen on their policy can also help their kids save when they leave the next. In fact, adult children of USAA car insurance customers qualify for a 10% family discount.

Other USAA discounts for young drivers are listed below:

- Driver Training Discount: It’s possible to save on car insurance premiums if you are under the age of 21 and willing to complete a driver training or defensive driving course.

- Safe Driving Discount: You can reduce your premiums by maintaining a good driving record for at least five years.

- Good Student Discount: Young drivers get a discount with good grades at school, and students from ages 16 to 25 may be eligible.

- Family Discount: Pay less for auto insurance when you add a teenager or young adult to an existing family policy.

Car Insurance Guide

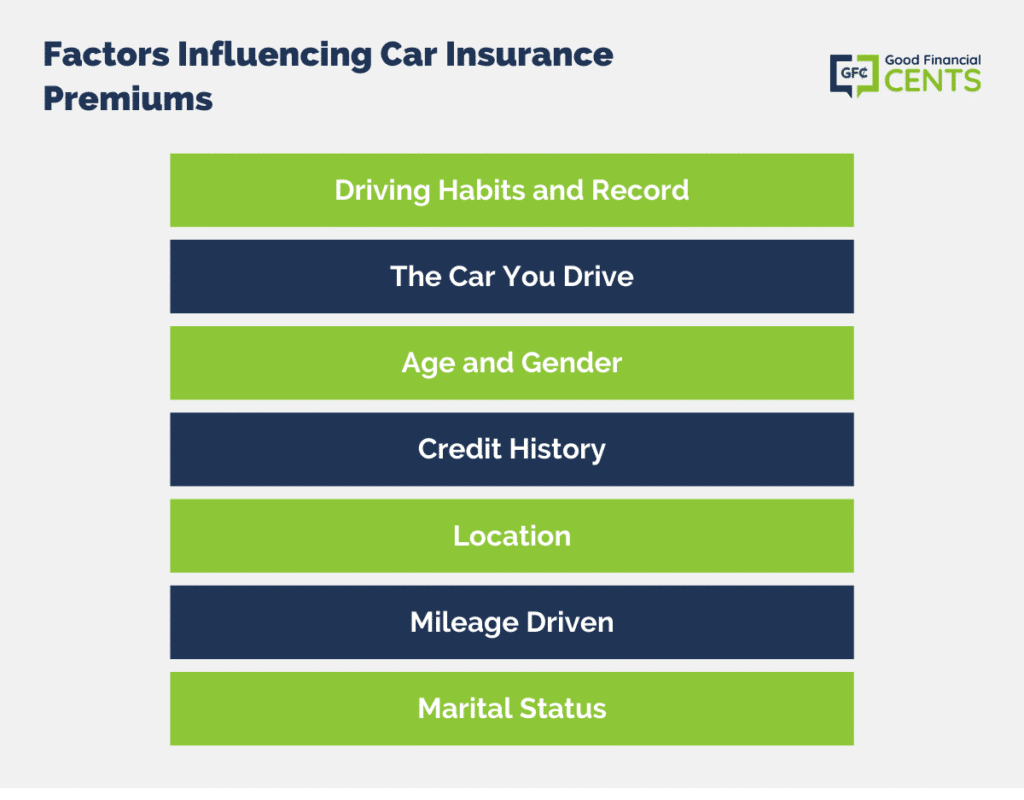

Before you settle on a new car insurance policy, you should understand the ins and outs of auto insurance for young drivers. For example, you’ll want to research the different types of car insurance, as well as the average cost of car insurance based on the policy you buy, where you live, and other factors.

How Does Car Insurance for Younger Drivers Work?

Car insurance for young drivers works the same as coverage for anyone else, yet this kind of insurance protection tends to be more expensive overall. The fact is, young drivers have considerably less experience on the road, and they consistently have accidents at a much higher rate as a result. According to the CDC on average 18 teens die every day in fatal car crashes. The Insurance Institute for Highway Safety reports that teens aged 16-19 are 3x more likely to get in a crash compared to those 20 years or older.

To account for this increased level of risk, car insurance companies charge higher premiums for the same types of coverage.

Generally speaking, however, car insurance rates tend to go down once individuals turn at least 25 with a safe driving record. Getting married can also help lower car insurance premiums considerably, as can becoming a homeowner, having a good credit score, and achieving other important life milestones.

As we noted already, the average premium for young drivers varies depending on where you live, whether you remain on a parent’s policy and other factors. However, a recent report from The Zebra shows that some age groups tend to pay much higher premiums overall, including some specific age groups below 25.

According to 2023 figures released in the study, drivers in the “teen†age group pay the most, with a typical 16-year-old driver paying an average of $6,034 per year for their own car insurance policy. Meanwhile, the average annual cost for all teenagers works out to $4,796 annually.

From there, each age group gets a better deal on auto insurance premiums until drivers reach their 60s and prices begin to tick up. The chart below shows the average car insurance premium by age group in 2023:

| Driver Age Group | Average Car Insurance Premium (Annual) |

|---|---|

| 20’s | $2,010 |

| 30’s | $1,495 |

| 40’s | $1,435 |

| 50’s | $1,350 |

| 60’s | $1,362 |

| 70’s | $1,569 |

| 80’s | $1,831 |

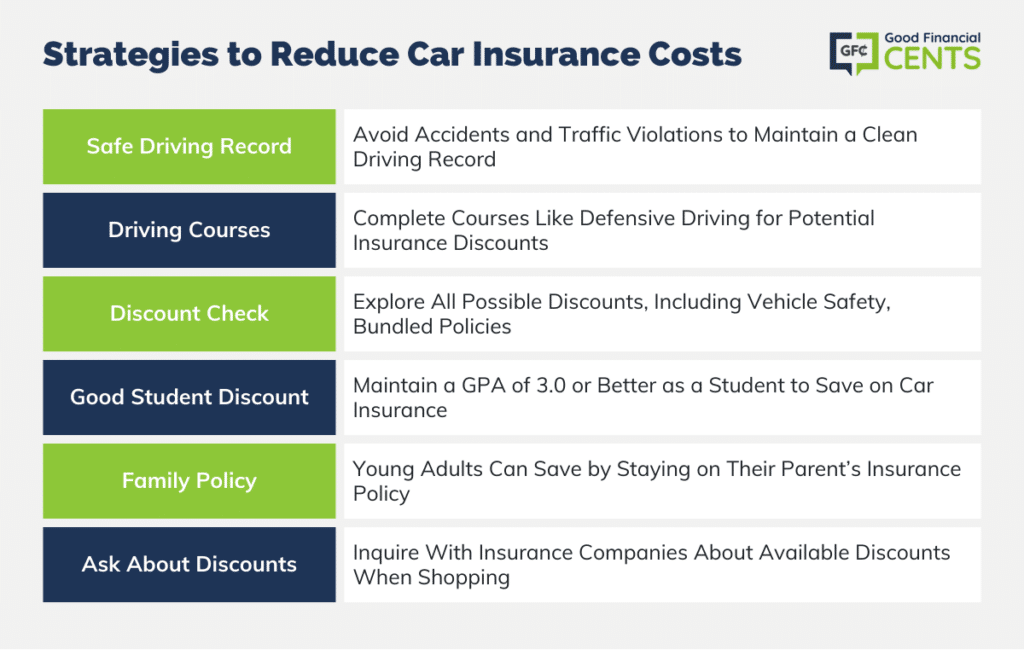

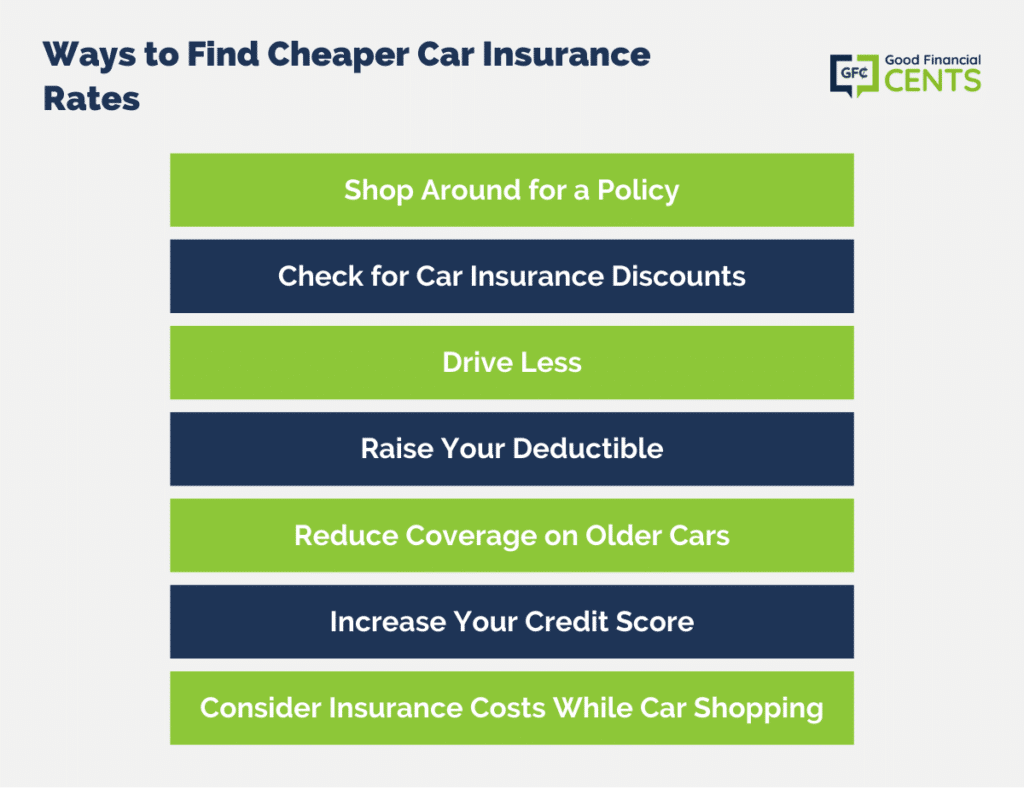

How to Lower Car Insurance Costs

Whether you decide to lease or buy a car or you’re currently driving an old beater while you wait for the best time to buy a new car, there are plenty of steps you can take to score more affordable car insurance premiums. Some of the best strategies you can use to save money are detailed below:

- Avoid accidents and moving violations. Getting into an accident or getting a ticket (or several) can cause your car insurance rates to surge higher than they already are. To get the cheapest car insurance possible, you’ll need to maintain a safe driving record for the long haul.

- Be willing to take driving courses. You may be able to save money on car insurance if you complete a teen driver education course or a defensive driving course. Make sure to check with your car insurance company to see which of these options can help you score a discount.

- Check for all possible discounts. You may qualify for car insurance discounts you don’t even know about, but you’ll never know unless you check. See whether your insurance company offers vehicle safety discounts, bundled policy discounts, loyalty discounts, or other discounts that can help you save money.

- Get good grades. If you’re a college student and you can maintain a good grade point average, chances are good you can score a discount on your car insurance premiums. For the most part, good grade discounts go to those who can maintain a GPA of 3.0 or better (or equivalent).

- Stay on your parent’s car insurance plan as much as possible. Generally speaking, car insurance rates for young adults are lower when they’re added to an existing policy. With that in mind, it can help to put off buying your own car insurance policy for as long as you can.

These are just some of the auto insurance discounts for students, but there might be others depending on the company you choose for coverage. When you shop around for your auto insurance policy, make sure to ask which discounts you might be eligible for.

Important:

How We Found the Best Car Insurance for Younger Drivers

To find the best car insurance companies on the market today, we looked for providers who have an ‘A’ rating or better for financial strength from A.M. Best.

We also looked for companies that offer highly-rated mobile apps, as well as those that advertise special programs and discounts for teen drivers.

Finally, we only considered car insurance companies that have an ‘A’ rating or better with the Better Business Bureau (BBB).

Summary of the Best Car Insurance for Younger Drivers November 2024

- Nationwide: Best for Teen Drivers

- American Family: Best for Usage-Based Discounts

- Allstate: Best for Good Students

- State Farm: Best for Safe Vehicle Discounts

- Geico: Best Discounts Overall

- USAA: Best for Military

The post Best Car Insurance for Young Drivers in 2024 appeared first on Good Financial Cents®.

]]>The post Best Mortgage Refinance Companies of 2024 appeared first on Good Financial Cents®.

]]>Not only do they have smart and streamlined processes in place to make the entire process hassle-free, but they offer plenty of loan options, competitive interest rates, and flexible closings.

If you’re in the market for a mortgage refinance, it helps to know which lenders offer the lowest mortgage rates and the best shopping experience.

We compared all the major mortgage refinance lenders available today to find options with low rates and fair terms. Keep reading to see how they stack up.

Table of Contents

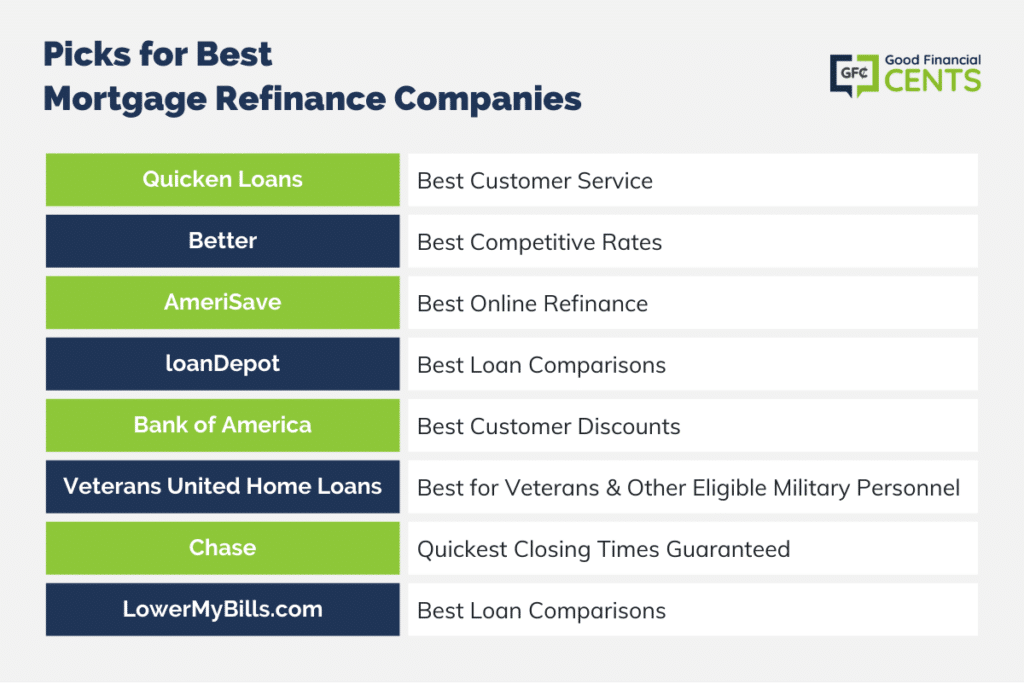

Company Reviews for Best Mortgage Refinance

The mortgage refinance process requires some upfront legwork, but the effort can be worth it if you wind up with a better loan. The companies we chose for our ranking of mortgage lenders can help you save money, pay off your loan faster, or both.

Read over the basic information for each home loan company to find the best option for your needs.

Quicken Loans

Also referred to as Rocket Mortgage, Quicken Loans is known for its seamless online mortgage refinancing process and how easy it is to get started.

Through Quicken’s dynamic online platform, a borrower can upload all the required paperwork, oversee their process, and finish the bulk of the refinance process online.

The company also boasts excellent reviews from past users, and it earned the second spot in J.D. Power’s U.S. Primary Mortgage Origination Satisfaction Study.

Quicken Loans offers origination loans, traditional refinancing, cash-out refinancing, and more through its online portal. Customers can also lean on this lender for help with conventional home loans, VA home loans, FHA loans, USDA loans, and more.

Loans Offered:

Better

Better promises mortgage refinancing with no lender fees or commissions, and it has streamlined the entire process with modern-day technology. Better applicants get instant mortgage rates after answering just a few questions, and the process is visible and transparent all along the way.

Although the company has only been in operation since 2016, Better has already funded over $1.7 billion in loans. Applying for a mortgage refinance can be done entirely online, and you’ll get a quote immediately without having to speak with a mortgage officer.

Loans Offered:

AmeriSave

AmeriSave is an online mortgage lender that offers new home loans as well as mortgage refinance products. This company lets you qualify for lower rates than many brick-and-mortar banks, and you can even wrap your loan closing costs into your new loan if you agree to a slightly higher APR.

AmeriSave also lets you get a free quote for your new loan online. From there, you can complete the entire loan application process using their website and online portal to upload documents.

When it comes to closing on your new loan, they’ll complete the closing anywhere you want — even in your home.

Loans Offered:

loanDepot

If you’re wondering how to get a mortgage and hoping to complete the bulk of the process from the comfort of your own home, look no further than loanDepot.

This online lender promises refinance products with lower interest rates and/or lower monthly payments than you have now, and with a seamless application process, you can complete entirely online.

After you refinance with loanDepot once, they’ll also waive all the lender fees the next time you use them to refinance a mortgage.

While newer in the industry than some of the other refinance companies out there, loanDepot has funded more than $100 billion in loans since 2010. It’s also important to note that loanDepot scored higher than average in J.D. Power’s U.S. Primary Mortgage Origination Satisfaction Study.

Loans Offered:

Bank of America

Bank of America promises consumers who want to refinance a “digital mortgage experience†that makes the process more convenient. You can apply for a refinance online, over the phone, or in person, and you can choose from a wide range of mortgage products to suit your needs.

Online preapproval is also offered, and Bank of America offers competitive interest rates and low down payment options.

Bank of America Preferred Rewards clients can also qualify for a $200 to $600 reduction in their loan origination fee. This makes Bank of America an especially lucrative option for consumers who already have a working relationship with them.

Loans Offered:

Veterans United Home Loans

Veterans United Home Loans is a premier mortgage company for veterans and active-duty military who meet “the basic service requirements set by the Department of Veterans Affairs (VA), have a valid Certificate of Eligibility (COE), and satisfy the lender’s credit and income requirements.â€

This means you must have a qualifying military affiliation to refinance your mortgage with this lender.

Veterans United can help connect you with the best VA home loans today — often with lower closing costs and the most competitive rates out there today. Veterans United has also received excellent reviews with an average star rating of 4.9 out of 5 stars across more than 10,000 reviews on Trustpilot.

Loans Offered:

Chase

While Chase Bank is popular for its banking products and rewards credit cards, it also offers home loans and mortgage refinancing.

Their mortgage refinancing product lets you replace your home loan with a new one that offers better rates and terms, and you can likely complete the bulk of the mortgage refinance process online.

Chase promises some of the lowest rates available, and you can even begin the mortgage refinancing process online. The bank also offers a closing costs guarantee that promises you’ll close on time in as little as three weeks, or you’ll get a check for $5,000.

Loans offered: Traditional home loans, adjustable-rate mortgages, jumbo loans, VA loans, FHA loans, USDA loans.

Loans Offered:

LowerMyBills.com

LowerMyBills.com is not a mortgage lender, but it is a marketplace that lets you compare multiple home loans in one place.

This platform lets you enter basic information about your current mortgage, your monthly payment, and your credit score range to get an idea of the new loan term you could qualify for.

If you decide to move forward and apply, you can enter your information once and get quotes from multiple lenders on the same day. LowerMyBills.com also offers a nifty mortgage refinance tool that lets you see how much you could save with a new home loan.

Loans Offered:

Mortgage Refinance Guide

If you’re wondering what to do before refinancing, when to refinance, or how to begin the process, you’re in the right place. Read on to learn more about what goes into refinancing your mortgage, why refinance rates are higher than purchase rates, and the paperwork and forms you’ll need to get started.

Benefits of Refinancing a Mortgage

The benefits of a mortgage refinance depend on the homeowner and their specific situation. For example, many consumers refinance in order to decrease the length of their loan term or lower their monthly mortgage payments.

Due to the fact that you get the chance to change up your loan term, refinancing is also one of the best ways to pay off a mortgage early.

If interest rates are considerably lower than they were years ago, refinancing to secure a lower interest rate can also help consumers save money on interest over the life of their loan.

Another benefit of refinancing right now could come into play if the value of your home has increased but you’re still paying private mortgage insurance (PMI) on your original home loan.

By comparing mortgage options, applying for a refinance, and seeking out an appraisal, homeowners with considerable home equity can get the PMI removed from their mortgage.

Cost to Refinance

According to ClosingCorp, the average cost of refinancing worked out to $6,837 nationally including taxes and $3,836 excluding taxes in 2021. Further, closing costs as a percentage of purchase prices declined in 2021 to 1.03% when compared to the 1.06% average in 2020.

That said, your personal closing costs will depend on a broad range of factors including your current income, your debt-to-income ratio, your credit history and credit score, the type of loan you choose, the loan amount, and your loan term.

Potential costs to watch out for and compare include closing costs, loan origination fees, points, and more.

Best Time to Refinance

Generally speaking, there are a handful of times it makes sense to trade your current home loan for a new one. Should you refinance your mortgage, one of the scenarios below will likely come into play:

- Securing a lower monthly mortgage payment

- Getting a lower interest rate

- Reducing the loan term on your mortgage

- Switching loan products from a 15 vs. 30-year mortgage

- Refinancing to remove PMI

- Switching from a variable rate to a fixed rate (or vice versa)

Any of these situations can create a prime opportunity for mortgage refinancing, but you should still run the numbers to make sure you’ll still end up ahead.

A mortgage calculator can help you compare your future monthly payment to your current one, as well as see how much you could save on interest based on current mortgage rates.

Requesting for Refinancing a Mortgage

After you compare loan offers and decide on a mortgage lender, you’ll need to gather some documentation to begin the refinancing process. Documents you’ll need to have ready can include:

- Proof of income, including W2s or pay stubs

- Homeowners insurance information

- Documents relating to other debts you have

- Statement of assets

- Tax returns

According to Quicken Loans, you may also need to present other documentation based on your situation.

For example, you may need to prepare letters of explanation for past credit issues or employment gaps, documentation that shows child support or alimony payments, or documentation related to bankruptcy on your credit history.

While knowing what you need and gathering this documentation may feel overwhelming, remember that the best mortgage lenders can help walk you through the process. The majority also lets you upload required documentation online and from the comfort of your own home.

Different Kinds of Refinancing Products

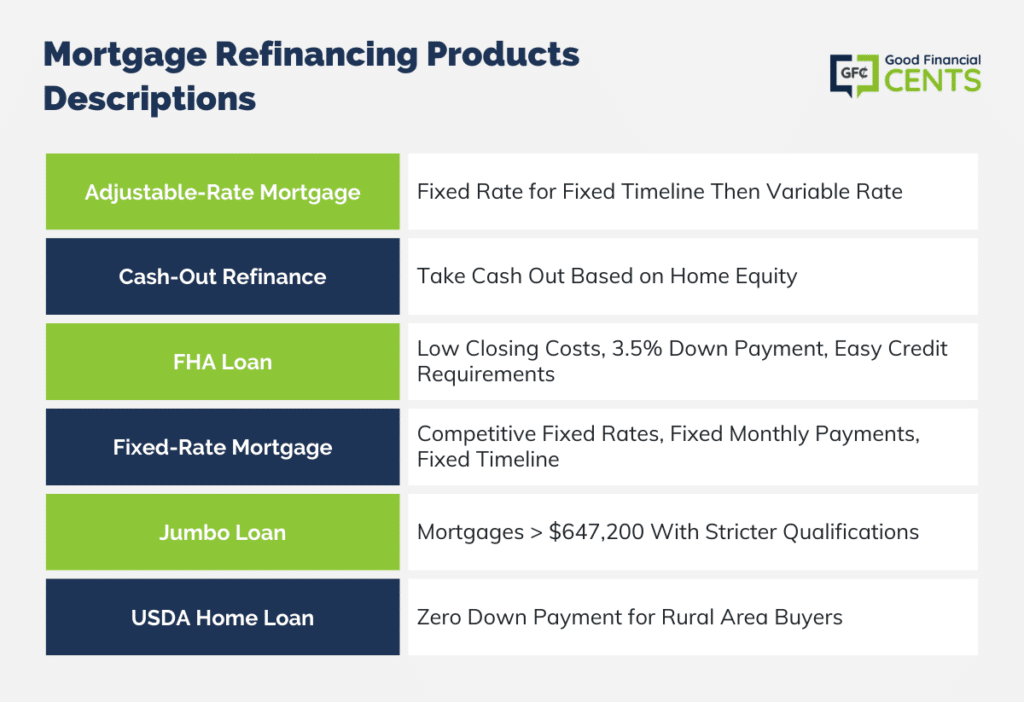

When it comes to refinancing your home mortgage, you get to choose from nearly any type of mortgage out there. Generally speaking, your options can include the following:

Adjustable-Rate Mortgage

- Adjustable-Rate Mortgage: An adjustable-rate mortgage comes with a fixed rate for a fixed timeline followed by a variable interest rate for the duration of the loan. With a 7/1 ARM, for example, consumers pay a low fixed rate for seven years followed by a variable rate that changes based on market conditions.

Cash-Out Refinance

- Cash-Out Refinance: While you can refinance your mortgage to secure a lower monthly payment, a lower interest rate, or both, you may also be able to take cash out based on how much equity you have.

FHA Loan

- FHA Loan: FHA loans come with low closing costs, down payment requirements as low as 3.5%, and easy credit requirements.

Fixed-Rate Mortgage

- Fixed-Rate Mortgage: Fixed-rate mortgages come with competitive fixed rates, fixed monthly mortgage payments, and a fixed repayment timeline.

Jumbo Loan

- Jumbo Loan: Jumbo loans are mortgages for homes that cost more than $647,200, and they have stricter qualification requirements as a result.

USDA Home Loan

- USDA Home Loan: USDA loans are zero down payment mortgages that are aimed at buyers in rural areas of the United States.

How We Found the Best Mortgage Refinance Companies

To find the best mortgage lenders of 2024, we looked for mortgage companies that offer transparency when it comes to their mortgage rates, their loan processes, and their loan options.

We compared mortgage lenders based on their ratings from third-party agencies like the Better Business Bureau (BBB) and J.D. Power, and we sought out companies that let consumers complete their refinance process online or over the phone with the help of a mortgage broker.

Ultimately, we chose the top home mortgage companies that offer mostly positive reviews, a broad range of mortgage options, competitive mortgage rates, and plenty of educational content for their customers.

We also gave preference to lenders who let consumers get a rate quote online without a hard inquiry on their credit report.

Bottomline – Best Mortgage Finance Companies

In 2024, for those on the hunt to refinance their mortgage, the landscape is rife with promising options. With companies like Quicken Loans leading in customer service and Better offering competitive rates, homeowners have a robust selection.

Whether you prioritize online processes, loan comparisons, or specific discounts, there’s a lender tailored to meet those needs. Before diving into the decision, it’s worth exploring these top contenders to ensure a smooth refinancing experience.

The post Best Mortgage Refinance Companies of 2024 appeared first on Good Financial Cents®.

]]>The post How to Remove Negative Items From Your Credit Reports appeared first on Good Financial Cents®.

]]>Fortunately, there are standard steps to take if you want to keep your credit score in good shape. For example, paying all your bills on time and keeping your credit utilization in check can go a long way toward helping you build the credit you’ll need later in life. In the meantime, you’ll also want to check your credit reports for incorrect reporting and false information, all of which can negatively impact your score without you even knowing.

Just remember that having negative items removed from your credit reports only works if they are actually untrue. The CFPB points this out very specifically on their website:

Table of Contents

- How Credit Scores Are Calculated

- What to Do If You Find Something Wrong in Your Reports

- How to Dispute Negative Items on Your Credit Reports

- Credit Bureau Dispute Information

- Common Credit Report Errors and Entries That Hurt the Most

- Final Thoughts on Removing Negative Items From Your Credit

- FAQs on Removing Negative Items on Credit Reports

How Credit Scores Are Calculated

In addition to checking your credit reports for errors, you should have a general idea of how credit scores are calculated. You probably have additional questions you want answered as well.

For example, what is a good credit score? And what is a bad credit score?

First off, you should know that the most important credit scoring model is the FICO scoring. Meanwhile, VantageScore is the second most commonly used credit scoring model.

Since FICO credit scores are used by 90% of top lenders, we’ll focus on this type of credit score for the purpose of this guide. Like VantageScore, FICO credit scores fall between 300 and 850, with higher scores being superior to lower credit scores.

According to myFICO.com, FICO credit scores are also separated into the following ranges:

- Exceptional: 800+

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 559

- Poor: 580 or less

If you’re wondering where you stand, you should know that Experian reported that the average FICO score came in at 714 in 2022. This means that, for the time being, most American consumers have what is considered a “good†credit score.

What to Do If You Find Something Wrong in Your Reports

To keep your credit score in the best possible shape, you should make sure you read over your credit reports from all three credit bureaus — Experian, Equifax, and TransUnion — at least a few times each year. Doing so can help you spot inconsistencies in your credit reports and even false reporting or mistakes.

To get a look at your credit reports from all three bureaus, you should use the website AnnualCreditReport.com. This portal lets you check all of your credit reports for free up to once per week, and you can complete the entire process online.

How to Dispute Negative Items on Your Credit Reports

If you find any errors on your credit reports, especially errors that may be hurting your score, you should take steps to have them removed. Just remember that you will only have success having negative reporting removed from your reports if the information is actually incorrect.

The FTC notes that you’ll need to dispute any incorrect reporting with both the credit bureaus that report the information and the company that supplied the data. If your Experian credit report shows a late payment on your Wells Fargo car payment, for example, you would need to dispute the information with both Experian and Wells Fargo.

If the false information was on all three of your credit reports, on the other hand, you would need to send the same information to Experian, Equifax, TransUnion, and Wells Fargo.

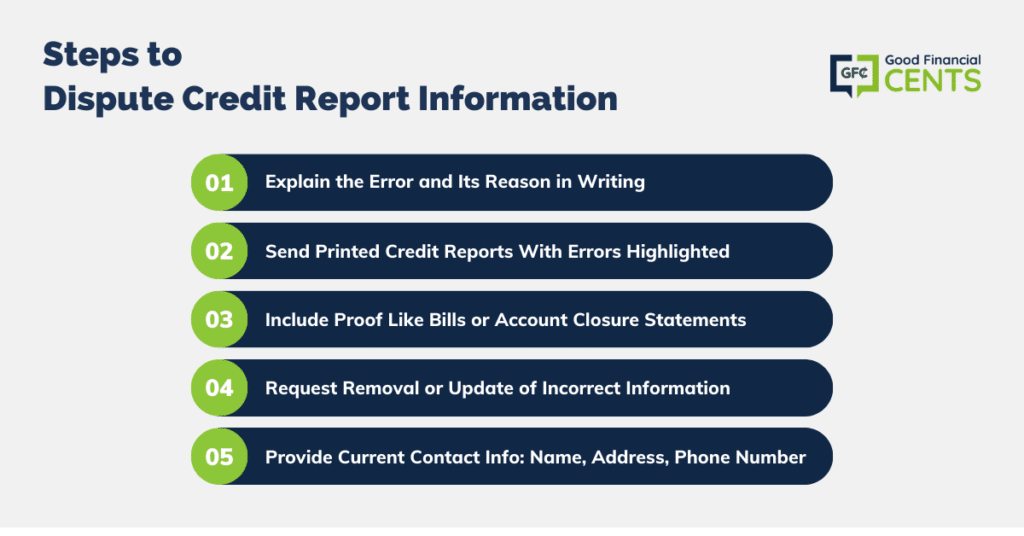

Steps you’ll need to take to dispute information on your credit reports include:

- Step 1: Explain in writing what you think is wrong on your credit reports, along with the reason the information is incorrect.

- Step 2: Send printed copies of your credit reports with your letter, and make sure to highlight or circle the incorrect information.

- Step 3: Include any proof you have that the information is wrong, such as a bill that shows your balances have been paid or an account closure statement.

- Step 4: Request in writing that the incorrect information you’re writing about is removed or updated.

- Step 5: Make sure to include up-to-date contact information for yourself when you contact each company, such as your name, address, and phone number.

Note that you can put together a single packet of this information and send it to the credit bureaus and the company that reported the information. In some cases, however, credit bureaus also have their own dispute form you can send along.

If you’re not disputing information on your credit reports online, make sure to send the information for your dispute via certified mail.

Either way, you’ll want to send the information to the appropriate credit bureau using the information below, and you can send the information to the reporting company using the address listed on your credit report.

Credit Bureau Dispute Information

| CREDIT BUREAU WEB PAGE | ADDRESSES FOR DISPUTES BY MAIL | PHONE NUMBER |

| Experian | Mail the Dispute Form With Your Letter to: ExperianP.O. Box 4500Allen, TX 75013 | (888) 397-3742 |

| Equifax | Download the Dispute Form and Mail Your Letter to: Equifax Information Services LLCP.O. Box 740256Atlanta, GA 30348 | (866) 349-5191 |

| TransUnion | Download the Dispute Form and Mail Your letter to: TransUnion LLCConsumer Dispute CenterP.O. Box 2000Chester, PA 19016 | (800) 916-8800 |

If all of this sounds overwhelming, it’s also worth mentioning that the best credit repair companies can take on this work for you. Not only can these companies pore over your credit reports to check for errors, but they can dispute errors and misreporting on your behalf.

For example, Lexington Law charges reasonable fees in exchange for handling all aspects of credit repair ranging from disputing incorrect information on your credit reports to bankruptcies, collections, foreclosures, and more. The company also lets you complete the entire process online and over the phone, so you won’t have to drive to a credit repair office or spend time meeting with someone in person.

Common Credit Report Errors and Entries That Hurt the Most

While it’s possible almost anything on your credit report could be a mistake, the Consumer Financial Protection Bureau (CFPB) says the following credit report errors are some of the most common:

- Wrong name or contact information

- Incorrect accounts that exist due to identity theft

- Closed accounts that are reported as open

- Accounts that are falsely reported as late or delinquent

- Incorrect dates for last payments

- Debts listed more than once

- Incorrect balances

- Incorrect credit reports

- Accounts with an incorrect credit limit

Any of these errors could be hurting your credit score in some way, which is totally avoidable if you take steps to dispute incorrect data. If you’ve been wondering how to build your credit score, this is one move you’ll want to make at least a few times per year.

Related: How to Raise Your Credit in 5 Months

Final Thoughts on Removing Negative Items From Your Credit

If you want to improve your credit score so you can qualify for a mortgage, a car loan, or the best personal loans and credit cards, you should make sure you check your credit reports every few months. Doing so can help you discover errors before they cause too much damage, and you can also spot the early signs of identity theft.

Simply put, there are no downsides that come with checking your credit reports for free and disputing false items. If you fail to do so, however, you could live to regret it.

FAQs on Removing Negative Items on Credit Reports

You can get something taken off your credit report by contacting the credit bureau that is reporting it. You will need to provide proof that the item is incorrect or outdated. The bureau will then investigate and may remove the item from your credit report.

The following information cannot be disputed from your credit report: the name of the creditor, the account number, the date of the last activity on the account, and the credit limit.

Yes, you can legally remove things from your credit report. You can also dispute inaccurate or incomplete information on your credit report.

The post How to Remove Negative Items From Your Credit Reports appeared first on Good Financial Cents®.

]]>The post Best Way to Invest Your Money Right Now (Short-Term Options) appeared first on Good Financial Cents®.

]]>You need to keep your cash liquid so it’s easily accessible when you need it, which means you also need to invest in a way that doesn’t put you at too much risk of losing capital.

You will likely achieve a lower return than the best long-term investments offer as a result, yet that’s the price you pay for keeping your investment “safe.”

But, what are the best short-term investments out there right now?

In this article, we’ll break down the absolute best investment options for people with the following timelines:

- Best investments for up to three years

- Best investments for up to five years

If you have some cash to invest for up to five years and you’re wondering where to stash it, read on to learn about our top picks and how they stack up in terms of risk vs. reward.

Table of Contents

Best Ways to Invest for the Short-Term: Comparison Table

| INVESTMENT OPTIONS | INVESTMENT TIMELINE | RISK vs REWARD |

|---|---|---|

| High-Yield Savings Accounts Money Market Accounts | Less than 3 years | Roth IRA Short-Term Bond Funds Exchange-traded funds (ETFs) Short-Term Corporate and Municipal Bond Funds Series I Bonds |

| Crypto Savings Accounts Real Estate Investment Trusts (REITs) Short-Term Notes | Less than 3 years | Medium risk, medium reward Crypto savings accounts are returning up to 8.05% APY, although additional risk is involved REITs can earn exceptional returns, but the risk is higher and liquidity may be lower than other investments Short-term notes offer yields of 4.6% or higher, although returns can fluctuate |

| Roth IRA Short-Term Bond Funds Exchange-traded Funds (ETFs) Short-Term Corporate and Municipal Bond Funds Series I Bonds | Up to 5 years | Returns for Roth IRA accounts, short-term bond funds, short-term corporate and municipal bond funds, and ETFs vary widely, and you have the chance to lose capital over a shorter timeline Series I Savings Bonds are currently returning 6.89%, although liquidity can be a problem if you need your money quickly |

| Bonus Idea: Real Estate Hard Money Loans | Up to 5 years | Real estate hard money loans promise high yields but come with a relatively high amount of risk |

Best Investments for Timelines of Less Than 3 Years

When you know you’ll need access to your money in the next three years, you have to choose from low-risk investments that keep your cash liquid and easy to access.

The best short-term investments for up to three years can help you do exactly that, although some offer more liquidity than others.

If your timeline is 3 years (or less) your #1 goal is to protect your savings.

High-Yield Savings Accounts

Potential Interest Rate:

High-yield savings accounts offer a risk-free way to invest your money for the short term, albeit with a much lower guaranteed return than you can get elsewhere.

The best high-yield savings accounts come with yields of well over 4% APY, and many charge minimal account fees or no fees at all.

Even more importantly, the best high-yield savings accounts come with FDIC insurance, so your investment of up to $250,000 per account is fully protected if your bank defaults or closes its doors.

If you’re looking for the best high-yield savings account to open online, we suggest checking out offers from CIT Bank and, Discover, and Save Better.

5.26%

Interest Rate

varies

Min. Initial Deposit

- Stability: High

- Liquidity: High

- Transactional Costs: Low

Money Market Accounts

Potential Interest Rate:

The best money market accounts pay a little more than the best online savings accounts, and they also provide depositors with ATM cards, checks, and deposit slips.

Also note that money market accounts are based on the account balance, not the length of time you invest your money.

This makes money market accounts a good option for people who need a place to park their excess cash for the short term with the option to access their funds at any time.

Like other deposit accounts, you can also rest assured that your money market funds will be protected with FDIC insurance.

If you’re looking for a money market account that offers the highest potential return, you should check out options from banks like CIT Bank and Save Better.

- Stability: High

- Liquidity: High

- Transactional Costs: Low

Crypto Savings Accounts

Potential Interest Rate:

Crypto savings accounts also make it possible to earn interest on your crypto deposits, but it’s important to note the changing landscape in this industry.

For example, the amount of interest earned in these accounts can fluctuate wildly, and some crypto savings accounts are only available to investors who meet specific requirements.

The best crypto exchanges to check out include Gemini and others. At the moment, Gemini is offering up to 8.05% APY on crypto deposits, which are loaned out to other crypto investors similar to the way traditional banks loan out their funds.

That said, it’s worth noting that having a cryptocurrency savings account is not the same as having a savings account at your bank.

Not only do crypto savings accounts come without the protection of FDIC insurance, but there are ongoing concerns about digital theft.

Also, be aware that you may have to pay fees to sell your crypto and get your money out.

- Stability: Risky

- Liquidity: Medium

- Transactional Costs: Varies

Real Estate Investment Trusts (REITs)

Potential Interest Rate:

Real Estate Investment Trusts (REITs) offer another way to invest for the short term with less risk than the best long-term investments. This type of investment is made up of companies that own income-producing real estate that may be commercial, residential, or industrial in nature.

Investing in REITs lets you get exposure to returns from the real estate market without the added stress or gruntwork of being a landlord. REITs also let you invest in real estate with a lot less capital than you need to invest in physical property.

For example, a company called Fundrise sells private equity REITs, and investors can open an account and start building a real estate portfolio with as little as $10.

Just keep in mind that returns are not guaranteed with REITs and that you have the potential to lose money in the short term. However, Fundrise has performed well since the company’s inception in 2010.

After achieving average investment returns of 7.31% for their customers in 2020. It then backed those returns with 22.99% in 2021 and 1.5% in 2022.

1.5% might not seem like a good return but compared to the Public REIT sector which lost -25.10% that’s a good year. You can see my personal Fundrise returns here.

It’s also important to note that some REITs are more liquid than others. In fact, funds invested with Fundrise may be difficult to liquidate if you need your money quickly.

- Stability: Medium

- Liquidity: Low to Medium

- Transactional Costs: Varies

Short-Term Notes

Potential Interest Rate:

If you’re an accredited investor, you can invest in short-term notes through a company called Yieldstreet. The minimum investment starts at just $500, and short-term notes from Yieldstreet come with no hidden fees or expenses.

You can also choose among short-term notes that offer liquidity in as little as six months, so your investment will be somewhat liquid if you have a general idea of when you’ll need to access your money.

When you open an account with Yieldstreet, your monthly interest payments will be paid directly into your Yieldstreet wallet. Getting started with this platform is a breeze as well.

All you have to do is open an account, prove your accredited investor status, and then link a bank account online in order to transfer your funds.

- Stability: Medium

- Liquidity: Medium

- Transactional Costs: Low

- Access to wide array of alternative asset classes

- Access to ultra-wealthy investments

- Can invest for income or growth

Best Short-Term Investment Options for 3 Years or Less

| Investment Type | Potential Interest Rate | Description | Top Options |

|---|---|---|---|

| High-Yield Savings Accounts | 4.25% or More | Low-Risk, Liquid, FDIC-Insured Savings | CIT Bank, Discover, Save Better |

| Money Market Accounts | 4.05% or More | Slightly Higher Returns, With Liquidity | CIT Bank, Save Better |

| Crypto Savings Accounts | Up to 8.05% APY | Risky Crypto Savings, Varying Interest | Gemini and Others |

| Real Estate Investment Trusts (REITs) | Varies, Potentially High | Low-Risk Real Estate Investment, No Landlord Duties | Fundrise (Example) |

| Short-Term Notes | 4.6% or More | Accredited Investor Option, Low Minimum, Short-Term | Yieldstreet |

Best Investments for Up to 5 Years

If you want a place to park your investment for up to five years, you may feel comfortable taking on slightly more risk in exchange for the chance at higher returns.

The best short-term investments for up to five years tend to fit that criteria, although they may also offer less liquidity as a result.

Roth IRA

Potential Interest Rate:

A Roth IRA is a type of retirement account that can be funded with after-tax income. As a result, you are free to withdraw the contributions you made at any time. However, you cannot withdraw your earnings without a penalty before you reach retirement age, or at least 59 ½.

Once you open a Roth IRA, you can invest in any number of options from mutual funds to index funds, exchange-traded funds (ETFs), or bonds.

This money will grow regardless, and perhaps even until you retire. However, the fact you can access your contributions at any time makes the Roth IRA a smart place to invest over a short period of time, even up to five years.

If you’re looking for the best places to open a Roth IRA, you’ll want to check out M1 Finance, Betterment, and E*TRADE.

- Stability: Varies

- Liquidity: High

- Transactional Costs: Varies depending on which online brokerage firm you use to fund your account

Short-Term Bond Funds

Potential Interest Rate:

Short-term bond funds are products that are usually only managed by a professional financial advisor. Bonds are not as stable as money market accounts or high-yield savings accounts either, but they do offer the potential to earn a higher yield.

Short-term bonds usually mature in terms within 2 years or less, which can make them an ideal choice for investors with that type of timeline.

Where to buy bonds? Some of the best options for buying short-term bonds include M1 Finance and E*TRADE.

- Stability: High

- Liquidity: Low to Medium

- Transactional Costs: Varies

Exchange-traded Funds (ETFs)

Potential Interest Rate:

Exchange-traded funds (ETFs) are a type of pooled investment that are built to match a specific index, such as the S&P 500.

This makes ETFs somewhat similar to index funds, although ETFs can be traded throughout the day while index funds can only be traded at the end of the trading day.

Generally speaking, ETFs also tend to come with lower minimum investment amounts, and they can be more tax-efficient than index funds.

In addition to ETFs that track a specific index, investors can also choose among ETFs that track specific sectors of the economy or a specific commodity.

Trading fees for ETFs also tend to be on the low end, so they’re a good option for beginning investors who want to diversify their portfolio while also keeping costs down.

The good news about ETFs is the fact you can sell your investment and access your money at any time. On the flip side, you do have the potential to lose money in the short term.

- Stability: Varies

- Liquidity: High

- Transactional Costs: Varies

Short-Term Corporate and Municipal Bond Funds

Potential Interest Rate:

Where a corporate bond is a debt instrument used to raise capital, a municipal bond is issued by a city, a town, or a state in order to raise money for various public projects.

Generally speaking, municipal bonds remain popular because they come with certain tax exemptions, and they are always deemed “safer” since they are issued by local or state governments.

In the meantime, corporate bonds are not backed by any government resources, so they’re deemed riskier as a result. On the flipside, corporate bonds may offer the potential for a higher return.

Either way, you’ll need a brokerage account with a firm like E*Trade to be able to trade individual bonds, bond mutual funds, and bond ETFs. Likewise, you can buy municipal bonds through bond dealers, banks, and brokerage firms.

- Stability: Varies

- Liquidity: Medium

- Transactional Costs: Varies

Series I Savings Bonds

Potential Interest Rate:

Series I Savings Bonds are government-backed bonds that earn interest based on a fixed rate and a variable rate that is updated twice per year. For bonds issued now through April of 2023, the rate is 6.89%.

This type of bond doesn’t require you to pay any state income taxes, although federal income taxes apply. Just remember that Series I Savings Bonds aren’t quite as liquid as some other investments.

For example, you can only cash them out after you have had them for at least one year. If you cash out your Series I Savings Bonds before five years, you’ll also lose three months of interest.

It’s also worth noting that each individual can only purchase up to $10,000 in Series I Savings Bonds each year. That makes these bonds a poor option if you need to invest $20,000 or you have $50,000 to invest right away.

- Stability: High

- Liquidity: Medium

- Transactional Costs: Low

Bonus Idea: Real Estate Hard Money Loans

Potential Interest Rate:

Real estate hard money loans work differently than traditional mortgage lending, mostly because the borrowing requirements are looser than a traditional home loan.

This means the investor buying a property can get their hands on their loan funds considerably faster (usually a matter of days instead of weeks or months), yet they pay a higher interest rate and have a much higher down payment requirement.

Investors who put their money into real estate hard money loans take on considerably more risk as a result. That said, the returns can be exceptional for investments that pay off.

Also note that real estate hard money loans usually last for just a few years, which makes them unique from traditional home loans that last 15 to 30 years.

That said, investors who take on these loans won’t get their money back until the borrower pays their loan off, so they’re not nearly as liquid as other investment options.

- Stability: Low

- Liquidity: Low

- Transactional Costs: Varies

Best Investment Options for Short-Term Gains (Up to 5 Years)

| Investment Option | Interest Rate | Description | Stability | Liquidity | Transactional Costs |

|---|---|---|---|---|---|

| Roth IRA | Varies | Tax-Advantaged Retirement Account for Short-Term Investing | Varies | High | Varies |

| Short-Term Bond Funds | Varies | Professionally Managed Bonds With Higher Yields for Short-Term Investors | High | Low to Medium | Varies |

| Exchange-Traded Funds (ETFs) | Varies | Pooled Investments Mirroring Indices or Sectors, Offering Flexibility | Varies | High | Varies |

| Short-Term Corporate and Municipal Bond Funds | Varies | Mix of Corporate Bonds for Potential Returns and Municipal Bonds for Safety Requires Brokerage Accounts | Varies | Medium | Varies |

| Series I Savings Bonds | 6.89% (Variable) | Government-Backed Bonds With Fixed and Variable Rates, Some Liquidity Restrictions | High | Medium | Low |

| Real Estate Hard Money Loans | Varies | Riskier Real Estate Loans With Faster Access to Funds and Higher Returns, but Limited Liquidity | Low | Low | Varies |

What I Look for In a Short-Term Investment November 2024

There are all kinds of ways to invest your money for the short term, but you should definitely be picky when it comes to money you may need in the next few years.

After all, you want to make sure you aren’t taking on too much risk, especially when it comes to risking substantial loss of capital. Yet, you also need to ensure your money will be somewhat easy to access when you need it.

The main factors I look for when comparing short-term investments include:

- Stability: The best short-term investment options tend to have a low risk of losing money over the short term, or at least not over any period of three to five years.

- Liquidity: Short-term investments should also be somewhat liquid, or at least accessible within a one to five-year timeline.

- Low Transaction Costs: Short-term investments shouldn’t require you to pay exorbitant fees to access your money or to invest in the first place.

All the short-term investments we have outlined in this guide fit this criteria to a certain extent, although there are certainly some pros and cons to consider with each option we recommend.

For example, investing in Series I Savings Bonds gets you a guaranteed return of 4.3%, yet you won’t be able to access your money for a least one year and you’ll give up three months in interest if you cash out your bonds within the first five years.

On the flip side, a high-yield savings account offers considerably less interest than that, but your money is protected with FDIC insurance and easy to access at any time.

With this in mind, you should remember that achieving a higher yield typically means taking on slightly more risk or giving up some liquidity. The best short-term investment for your money will offer a balance of these factors you can live with.

The post Best Way to Invest Your Money Right Now (Short-Term Options) appeared first on Good Financial Cents®.

]]>The post Is Pet Insurance Worth It? appeared first on Good Financial Cents®.

]]>The thing is, the best pet insurance can actually make being a pet owner considerably more affordable — particularly if your pet winds up needing surgery or being diagnosed with a chronic medical condition.

The key to getting ahead with pet insurance is choosing from the best pet insurance companies and selecting a plan with the deductible, waiting periods, and reimbursement levels that make sense for your pet.

Table of Contents

- Pet Insurance Cost Comparison

- Pet Insurance Guide

- What Does Pet Insurance Cover?

- Understanding Common Exclusions in Pet Insurance

- How Much Does Pet Insurance Cost?

- How Does Pet Insurance Work?

- Pros and Cons of Pet Insurance

- How to Find the Best Pet Insurance Policy

- Bottom Line – Is Pet Insurance Worth It?

Pet Insurance Cost Comparison

The chart below shows how much pet insurance costs from a few different pet insurance companies we recommend. After that, we’ll go over all the intricacies of pet insurance plans and how pet insurance works.

| PET VARIETY | TRUSTEDPALS | HEALTHYPAWS | FIGO | EMBRACE PET INSURANCE |

|---|---|---|---|---|

| Dog Insurance Female Mixed Breed Age 5 60 pounds | $34 to $89 Per Month | $59.92 Per Month | $43.22 to $69.95 Per Month | $39.53 Per Month |

| Dog Insurance Male Mixed Breed Age 2 25 pounds | $20 to $51 Per Month | $28.98 Per Month | $28.21 to $39.78 Per Month | $24.80 Per Month |

| Cat Insurance Female Mixed Breed Age 2 | $13 to $35 Per Month | $15.17 Per Month | $13.58 to $19.15 Per Month | $19.15 Per Month |

| Cat Insurance Male Mixed Breed Age 5 | $17 to $45 Per Month | $23.40 Per Month | $20.67 to $29.16 Per Month | $32.76 Per Month |

Pet Insurance Guide

The best pet insurance can help you cover mounting costs that rack up when your pet needs surgery or gets diagnosed with a chronic medical condition. After all, there are an array of pet care expenses you may have to cover, some of which you cannot predict ahead of time.

Many costs associated with owning a pet can add up to thousands of dollars during the course of a single year. Without a pet insurance policy, pet owners have no choice but to cover these expenses themselves.

As an example, CareCredit lists the following amounts for complex and emergency care costs for dogs and cats:

Common Pet Expenses for Emergencies and Chronic Conditions

| DISEASE/CONDITION | AVERAGE COST FOR DOGS | AVERAGE COST FOR CATS |

|---|---|---|

| Arthritis | $724 | $490 |

| Broken Bone | $2,371 | $2,257 |

| Cancer | $4,137 | $3,282 |

| Cancer Treatment (Chemotherapy) | $4,000 | $4,000 |

| Diabetes | $2,892 | $1,634 |

| Stomach Foreign Object | $3,262 | $2,955 |

What Does Pet Insurance Cover?

Just like monthly premiums, deductibles, and waiting periods that apply, the coverage options included in a pet insurance policy vary from company to company.

However, there are some general rules of thumb that come into play when it comes to what most pet insurance plans cover, as well as what they do not cover or rarely cover without an uptick in premiums.

What does pet insurance cover? While plans vary, most pet insurance plans provide some level of protection for the following:

- Accidents that occur, such as a broken bone during play or your dog or cat swallowing a foreign object

- Illnesses your pet is diagnosed with, such as cancer, arthritis, hypothyroidism, ear infections, and urinary tract infections (UTIs)

- Hereditary and congenital conditions, such as eye disorders, hip dysplasia, and heart disease

- Behavioral therapy that helps pets overcome behaviors such as excessive licking, fur pulling, and destructive chewing

- Exam fees can add up quickly if your pet has frequent vet visits

- Chronic conditions your pet may be diagnosed with, such as diabetes

- Prescription medication coverage, which can help your pet get the medicines it needs

- Preventative care for pets, such as vaccinations, exam fees, flea and tick medication, and more

Note that some of the above may be included in pet insurance plans automatically, whereas other types of coverage are typically offered as an optional add-on.

At the end of the day, you’ll need to compare pet insurance companies based on these inclusions, as well as on factors like your deductible, any waiting periods that apply, reimbursement levels, and more.

Understanding Common Exclusions in Pet Insurance

Pet insurance plans tend to have long lists of excluded items, and many do not provide coverage for older pets.

Common pet insurance exclusions include the following:

- Most pre-existing conditions your pet has, although pre-existing conditions are sometimes covered after waiting periods pass

- Cosmetic procedures, such as tail docking or ear cropping

- Expenses associated with breeding your pet

- Coverage for exotic pets

- Dental illnesses that occur unless you have specific coverage for pet dental care

- Costs associated with spaying and neutering your pet

- Alternative treatments for your pet, such as acupuncture, chiropractic care, rehabilitative therapy, and hydrotherapy

- Microchip implantation, which can help you find your pet if it gets lost or stolen

How Much Does Pet Insurance Cost?

The cost of pet insurance varies widely, so you’ll need to shop around and compare pet insurance quotes to find the best deal. That said, you should know that some factors that impact pet insurance costs are within your control, whereas others are not.

How much is pet insurance? Monthly or annual premiums are based on the following:

- Whether You Have a Cat or a Dog

- Age of Your Pet

- Breed of Your Pet

- Pet Insurance Discounts You May Be Eligible For

- Your State of Residence

- The Deductible You Choose for Your Pet Insurance Plan

- Reimbursement Levels for Your Plan

- Coverage Options Included

- Optional Add-on Coverage You Select

- Lifetime, Annual, or Per-Incident Maximums for Your Pet Insurance Policy

How Does Pet Insurance Work?

Pet insurance plans can work differently depending on the company you buy from. That said, most have similar features and several different tiers of coverage you can select from ahead of time.

For example, you can shop around for bare-bones pet insurance policies that provide limited coverage for catastrophic conditions after large deductibles are met and all waiting periods have passed.

However, you’ll also find premium pet insurance plans that provide generous coverage and include wellness coverage and a high reimbursement percentage for most conditions.

Consider the following example policy from TrustedPals pet insurance, which we received for a large (51 to 110 pounds) female dog named Madge, who is five years old.

As you can see, TrustedPals pet insurance offers three tiers of dog insurance coverage that range from budget-friendly to comprehensive.

Note how the budget-friendly and mid-tier plans have a higher deductible as well as annual coverage limits that apply.

In the meantime, the comprehensive plan comes with a lower monthly premium, a higher reimbursement rate, and no annual limit on payouts.

Let’s say your dog Madge swallows a foreign object, and you rack up $5,000 in vet bills as a result. The chart below shows how much each tier of this coverage could cost you for a single year, plus how much your coverage could save you in vet bills.

| EXPENSES | BUDGET PET INSURANCE | MID-TIER PET INSURANCE | COMPREHENSIVE PET INSURANCE |

|---|---|---|---|

| Annual Cost for Premiums | $408 | $624 | $1,068 |

| Deductible Required | $750 | $250 | $100 |

| Annual Reimbursement for $5,000 Vet Bill | $2,975 | $3,800 | $4,410 |

| Total Savings | $1,917 | $2,926 | $3,242 |

Pros and Cons of Pet Insurance

Pros

Cons

How to Find the Best Pet Insurance Policy

To find the best pet insurance policy for your pet and your budget, you’ll want to compare quotes from at least four or five different pet insurance companies.

Factors to consider and compare include:

- Monthly or Annual Premiums

- Reimbursement Levels

- Annual Limits on Payouts

- Pet Insurance Deductible Options

- Waiting Periods That Can Apply Before Coverage Kicks In

- Included Coverage Options

- Available Add-Ons, Such as Wellness Coverage, Dental Care, and Vaccinations

The best pet insurance for you depends on how much coverage you want, the reimbursement percentage you prefer, and the level of deductible you’re comfortable with.

In the meantime, you should check for plans that include the level of coverage you want for your pet’s preventative care needs, including coverage for wellness care, dental care, and more.

Bottom Line – Is Pet Insurance Worth It?

However, the intangible benefits, while harder to quantify, are equally compelling. The peace of mind that comes with knowing you won’t have to make a heart-wrenching decision based solely on financial constraints is invaluable to many pet owners.

Pet emergencies are unpredictable. The suddenness with which accidents or illnesses can strike means that without insurance, you might find yourself facing immediate, steep veterinary bills that you hadn’t budgeted for.

Insurance can alleviate much of this financial stress, allowing you to focus solely on the recovery of your pet.

Furthermore, advances in veterinary medicine have made treatments once reserved for humans now available to our pets. While these treatments can significantly improve the quality of life and lifespan of our pets, they can also be expensive.

Pet insurance can make these advanced treatments more accessible to the average pet owner.

However, as with all insurance products, pet insurance isn’t a one-size-fits-all solution. The premiums, coverage options, exclusions, and deductibles vary widely among providers.

Therefore, it’s crucial to do your homework. If you are on the fence about buying pet insurance, it’s advisable to take a proactive approach. Begin by comparing policies, reading reviews, and even speaking to other pet owners about their experiences.

Look for a policy that aligns with both the specific needs of your pet and your financial situation.

Remember:

The post Is Pet Insurance Worth It? appeared first on Good Financial Cents®.

]]>The post The 7 Best Student Loans for 2024 appeared first on Good Financial Cents®.

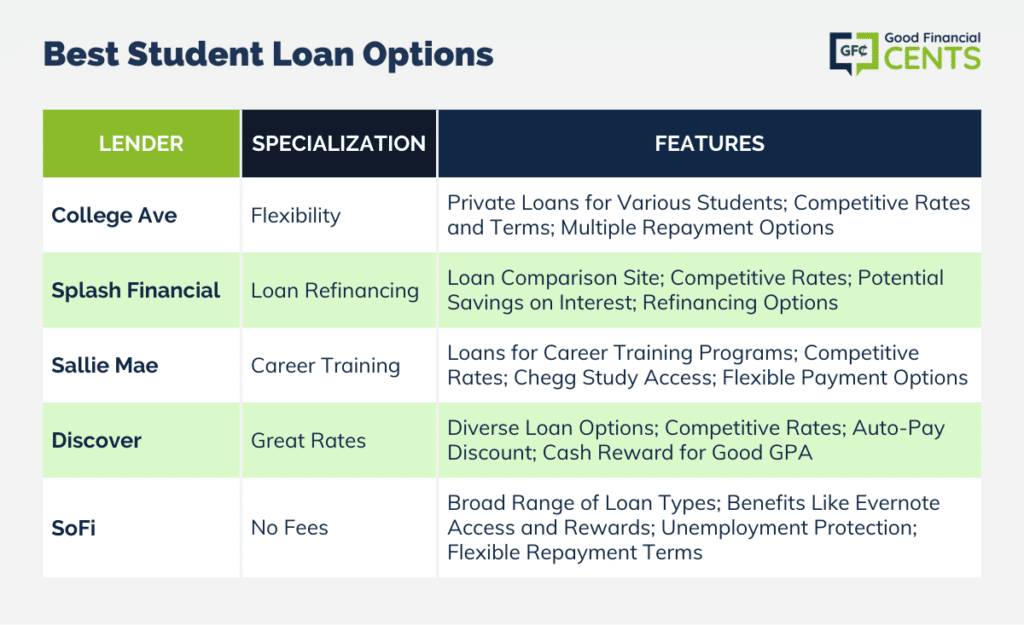

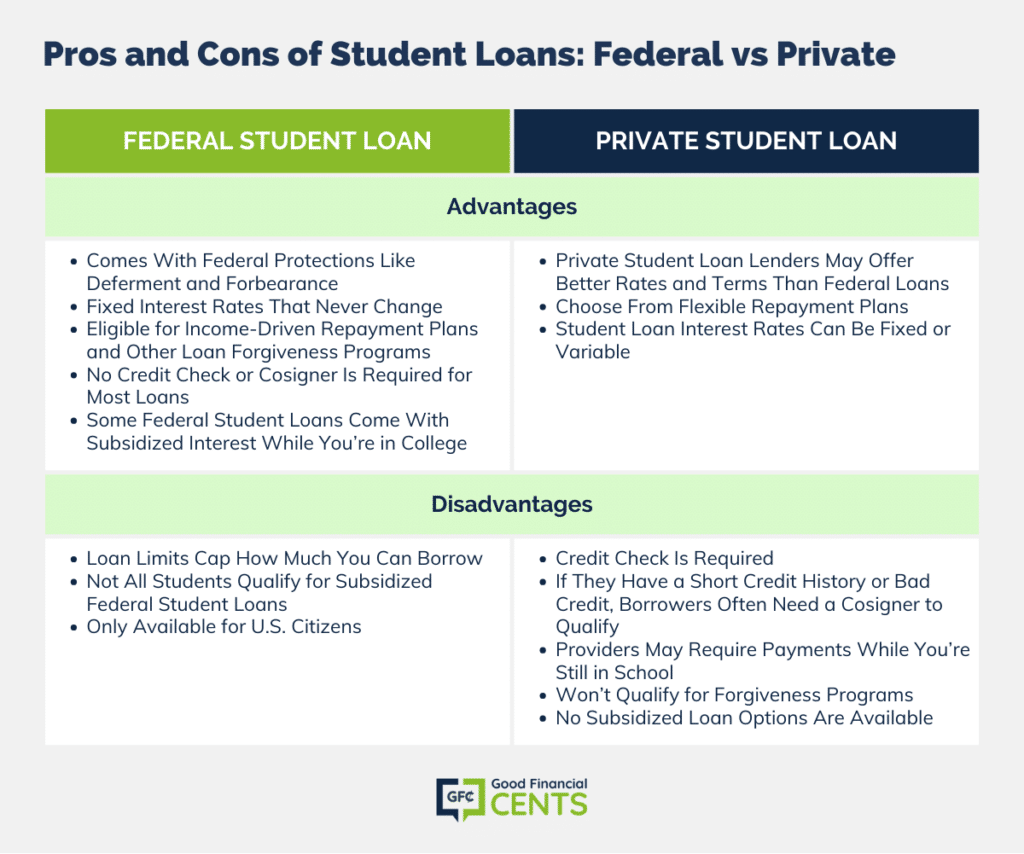

]]>While most borrowers should focus on federal student loans first, private student lenders can help you fill in funding gaps so you can get through school and graduate on time. If you’re in the market for a student loan from a private lender, read on to learn which seven companies we recommend, the type of student loans they offer, and details on who can qualify.

Table of Contents

Our Picks for Best Student Loans

- College Ave Student Loans: Best for Flexibility

- Splash Financial: Best for Student Loan Refinancing

- Sallie Mae: Best Career Training Loans

- Discover: Best Student Loans for Great Rates

- SoFi: Best Student Loans for No Fees

Best Student Loans – Lender Reviews

The following reviews explain how the best student loans work, which companies and online lenders offer them, and their main features and benefits.

College Ave offers private student loans for undergraduate and graduate students as well as parents who want to take out loans to help their kids get through college. Interest rates are highly competitive, and its student loans come with no origination fees, no prepayment penalties, and no hidden fees of any kind.

If the student attends a qualifying institution, they can apply for $1K or up to the total cost of attendance. Undergrads who need a larger amount can apply to the Multi-Year Peace of Mind loan program.

This student loan company also makes it possible for borrowers to complete their entire student loan application online, and it offers an array of helpful tools that can help you figure out how much you can afford to borrow, what your monthly payment will be, and more. Most College Ave student loans also come with multiple repayment options that can last for five years, eight years, 10 years, or 15 years.

Finally, students can decide when to begin making payments on their private student loans through College Ave. They can choose to make full interest and principal payments right away, but they can also opt to make interest payments, flat payments, or defer loan payments altogether during a grace period until after they graduate.